Developed by Intuit, the same company that is responsible for the popular TurboTax software, as well as Quicken, Mint is also fairly popular as a personal finance management-assistance app. Now with millions of regular users, Mint is available on iOS and Android, and has great integration features for your accounts.

Mint is a free budgeting app that syncs users' bank accounts, credit cards, PayPal.com - Get Report accounts and other accounts to help track incoming and outgoing money. Mint.com, the slick and extremely useful financial tracking website, also has iOS and OS X apps to natively keep an eye on your finances. The Mac app came out in early July of this year, and was. Learn more at YNAB Review 2020: The Most Effective Budgeting App Around? YNAB 2020: Which Budgeting App is Best? Banktivity With Banktivity you can link your accounts, track your spending, pay your bills, see your investments, and create budgets.

Being completely free (with ad-support) is one great thing about Mint, where other competing solutions may charge. You can integrate your financial accounts with it for real-time updates in managing your budget, investments, credit-card and bank accounts, and more. It also keeps track of your credit score, helping you manage it more effectively.

Not all accounts are link-able, however. Some financial institutions do not grant apps like Mint access to pulling account information for their customers, and if you have overseas accounts then you will be unlikely to be able to connect them to the app as it does not generally extend internationally. But for those who can take advantage of all its features, here is a run-down:

Positive Aspects of Mint

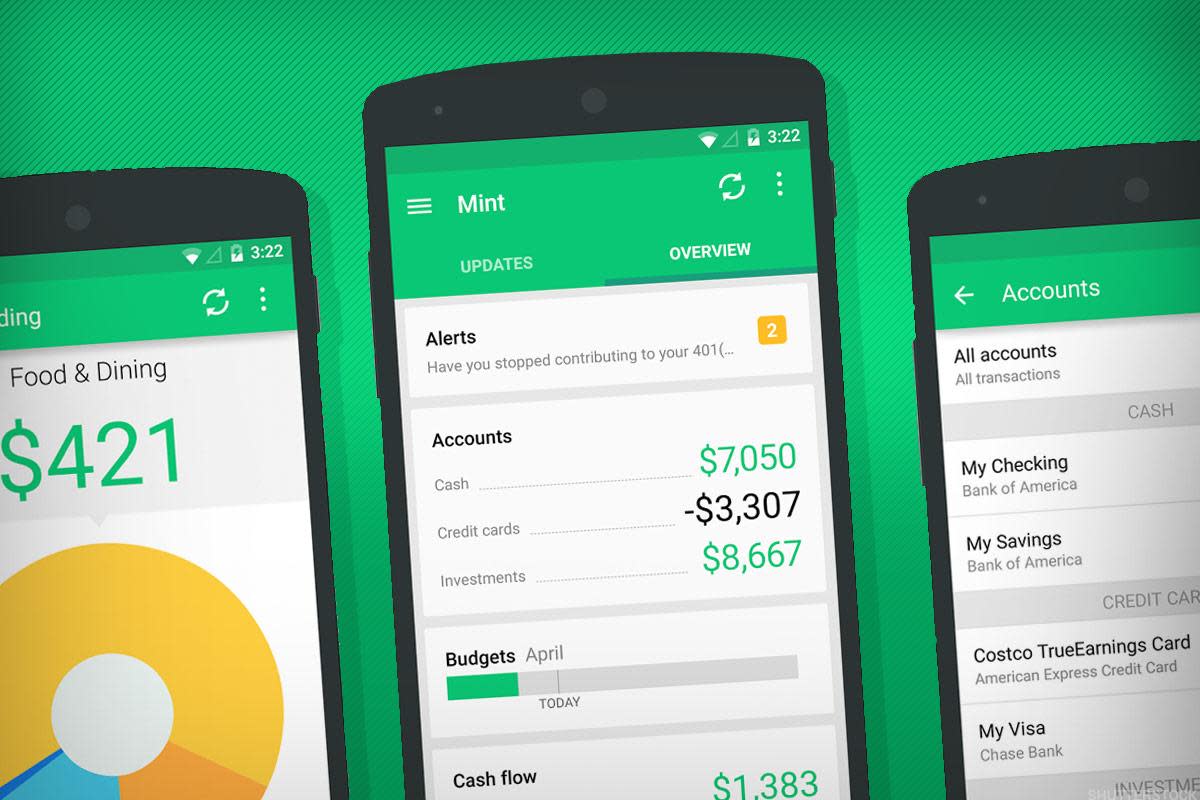

Financial hub: One of the best features of Mint is that it pulls all financial information into one central location. Once users have signed in and linked their accounts, they can view virtually every aspect of their financial lives through Mint’s dashboard: credit card and bank account balances, investment performance, credit score and even home value (provided by partner Zillow).

Automatic syncing: Mint makes getting a quick snapshot of spending easy. To get set up, all a user has to do is select the account provider — say, Bank of America — and sign in via Mint’s site or mobile app. Then the service pulls in all of the account information to give a quick view of account balances, transactions and even bills due. (Users can later direct Mint to “forget” an account if they want.)

Mint automatically starts categorizing transactions, though one of the most common user frustrations is that the categories are often wrong (more on this below). Users can fix incorrect categories and can split purchases, including splitting ATM transactions into the purchases made with cash.

Mint also immediately creates a budget, letting the user know how much he or she spent on, say, groceries, that month and how much the service thinks should be spent, based on past spending patterns and average spending in that category. The budgets, like much of the tool, are customizable.

Portfolio snapshot: When investment accounts like an IRA are linked, Mint gives a high-level overview of the investments within and how they are performing. It’s not the sort of detail users would get by logging in to the brokerage account itself, but it’s more than enough to see where those accounts stand.

Download mac apps. Opening an App with the Mac Spotlight. This is one of the easiest ways to open a program on your. The simplest way to launch an app from the keyboard is to use Spotlight. Opening an Application: Launch Terminal. Look for Terminal in 'Applications' → 'Utilities' →.

The service also allows users to compare their portfolio performance to various benchmarks, like the S&P 500 and Dow Jones Industrial Average, looking at all accounts at once, each individual account alone or even individual investments within accounts.

Trends overview: The Trends tab gives users a quick look at where they stand — how much they’ve spent in various categories, such as shopping, groceries, food and dining, and entertainment. Users can easily refine the time frame, selecting from options such as this month, last seven days and last 14 days, or creating a custom window and viewing month over month or comparing to the same time last year.

Free credit score: All Mint users get a free credit score, displayed on the dashboard at each login. It’s not hard to come by a free credit score these days, but Mint excels in the way it shares the information, cutting out the noise to show users everything they need to see and nothing they don’t.

The site’s credit score page is much easier to digest than a standard credit report, and gives much of the same information: age of credit, total accounts, number of inquires, derogatory items and on-time payment history. The information comes from credit bureau Equifax and can be updated with the click of a button every three months.

You can also easily capture your screen, apply various filters and effects or use batch processing tools.The app works with different file formats, RAW files included. Free photo apps for windows 10. Here, you can find tools for photo retouching, color correction, managing and viewing your pictures. Its interface is nicely organized.

Alerts: Mint’s alerts can keep users out of trouble. The service can send out a notification if a budget is exceeded, a bill is due soon, too much was spent on ATM fees or it recognizes unusual spending activity, in an attempt to thwart identity theft.

Mobile app: The bulk of Mint’s users are on mobile, and the service’s mobile apps (the overall app and Mint Bills for payments) are suitably strong. Users can quickly view recent purchases, get alerts and updates, characterize transactions and look at an overview of spending, trends and cash flow.

Where Mint falls short:

Ad targeting: Mint is free, but it has to make its money somewhere, and it does that by recommending products and services. In many cases, these can save users money or help consolidate debt.

But some of the recommendations seem invasive, and others are just off: In a test account, the company recommended rolling over an active employer 401(k) — viewing it as old, for some reason — into an IRA with Fidelity, one of the site’s featured partners.

Recommendations are grouped under the site’s Ways to Save tab, which serves up credit card, bank, insurance and other offers. It does seem to surface offers that would save the user money. But this section of the site didn’t function correctly every time, sometimes failing to load offers or not auto-populating the search fields with the user’s account information as it should.

Technical glitches: This is one of the biggest knocks against Mint: A surprising number of bugs, especially for such a dominant platform — too many to say that the service is truly easy to use. The site consistently and suddenly logged out test accounts during active use, and the credit score tool wouldn’t load on the first try. Mint also frequently disconnects from synced bank and credit card accounts, forcing the user to add them again. (The testing of the mobile apps didn’t surface similar issues.)

Mint also miscategorizes transactions frequently, although it’s fairly easy for a user to change the category and the site will remember the correct category next time. For example, if it categorizes a favorite restaurant as a grocery store, the user can set it straight and the next time a transaction is made there, the automated category should come through correctly.

Over-automation: Automatically syncing with accounts is a perk, for sure. But it also allows users to be truly hands off, which doesn’t do much to create a budgeting habit.

Users don’t have to look at their individual expenses with Mint, only a snapshot of their spending in categories. It’s an easy way to get a quick view — so easy that users may look only at that big picture and overlook red flags. Users can drill down for more detail, of course, but the site makes it easy not to do so — and that makes it harder to solidify a budgeting habit.

The bottom line

Without the technical bugs experienced during testing, Mint would earn rave reviews, as the service is clearly the most robust automated budgeting tool available. It’s a tool for reluctant budgeters — many people fall into that category, and they’ll be happy keeping tabs on their spending with this service.

It’s worth mentioning that the ‘People’ page is more than a contact list or address book. It gives you a detailed overview of ‘Message Requests’ from people you haven’t connected with on Facebook.Right in the message thread, Facebook Messenger shows when the recipient reads a message, and when she or he is formulating a new one. Messenger app for computer.

What’s your experience with Mint? Let us know below!

When you’re on top of your money, life is good.

We help you

effortlessly manage your finances

in one place.

All-in-one

financesWe bring all of your money to one place, from balances and bills to credit score and more.

Budgets

made simpleEasily create budgets, and see our suggestions based on

your spending.Unlimited

credit scoresCheck your free credit score as many times as you like, and get tips

to

help improve it.

All your money

in one place

We bring together all of your accounts, bills and more,

so you can conveniently manage your finances from

one dashboard.

See all of your bills and money at

a glanceCreate budgets easily with tips tailored

to youEnjoy access to unlimited free credit scores, without harming your credit

Effortlessly stay

on top of bills

Bills are now easier than ever to track. Simply add them to your dashboard to see and monitor them all at once.

Receive reminders for upcoming bills so you can

plan aheadNever miss a payment with alerts when bills are due

Get warned when funds are low so you know what you

can pay

We’re serious

about security

We’re committed to keeping your data secure. With multiple safety measures like secure encryption and multi-factor authentication,

we work to keep your information protected.

Sign in securely with your unique 4-digit code

and passwordRemotely access and manage your account

from anywhereEnjoy continuous protection with VeriSign

security scanning

Intuitive features,

powerful results

Mint Mac App Review Iphone

Mint is versatile enough to help anyone’s money make sense without much effort.

There’s no wrong way to use it,

and nothing to lose getting started. You’ll be surprised how

life-changing something so simple can be.

Learn More

Best mac os apps. Go to the app, Press Command + I and if there are other languages they will show up in the info page. Just untick all except the language you want.

Mint App On Windows 10

Budgets

that workCreate budgets you can actually stick to, and see how you’re spending your money.

Money on

the goPhone & tablet apps to manage your

money from wherever you are.One step

at a timeGet personalized tips and advice for

maximizing your money every day.Clean my mac app. By that, the price for each Mac computer will be lower.Currently, a single license of Clean My Mac 3 is selling for $39.95. That means you only need to spend $29.97 for each Mac computer. But if you buy a license for two Macs, it costs $59.95.

Sign up for Mint today

From budgets and bills to free credit score and more, you’ll discover the effortless way to

stay on top of it all.

Download our free

mobile app

Mint App Reviews

Available for iOS and Android.